The Mechanics of Falling Wedges

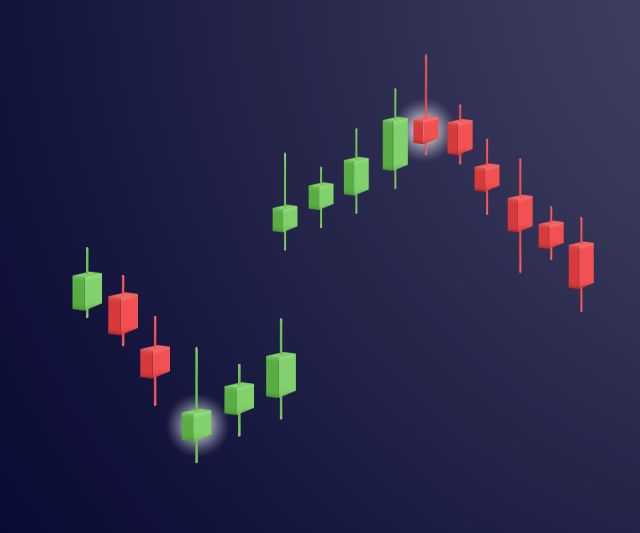

The falling wedge pattern works like a coiled spring in markets, where downward pressure gradually weakens until price breaks upward with renewed energy.

This pattern reveals a subtle shift in market psychology as sellers begin to lose conviction while buyers quietly accumulate positions at lower prices.

The tell-tale compression of price action, combined with decreasing volume, creates one of technical analysis's most reliable bullish reversal signals.

Understanding the psychological elements helps explain why these patterns so often lead to upward reversals. Early in the pattern's formation, sellers control the action, pushing prices lower as buyers step aside.

The Evolution of Buying Pressure

However, each new low shows less aggressive selling, reflected in smaller price ranges and lighter volume.

Think of it like a game of musical chairs in reverse - instead of players getting eliminated, more buyers start positioning themselves for the eventual move up while sellers gradually exit their positions. This shifting dynamic creates the compressed price action characteristic of falling wedges.

Statistical Reliability in Trading

The statistical reliability of falling wedge breakouts stems from this gradual transfer of control from bears to bulls. Research across multiple markets shows these patterns successfully predict bullish reversals approximately 68% of the time when properly identified.

For instance, a falling wedge in Bitcoin during the 2019 bear market showed classic compression over three months before breaking upward for a 40% rally. The key to these high success rates lies in the pattern's ability to identify precisely when selling pressure exhausts itself while new buying interest builds.

By measuring the decreasing volume and narrowing price ranges described in the previous section, traders can gauge when this reversal becomes most likely. This combination of psychological factors and measurable technical criteria makes falling wedges particularly valuable for timing market turns.

Why Falling Wedges Signal Bullish Reversals

Since the early days of technical analysis in the 1800s, traders have searched for reliable patterns that signal market reversals.

The falling wedge emerged as one of the most dependable formations during the grain trading boom of the late 19th century, when commodity traders first began mapping price patterns systematically.

Charles Dow, the founding father of technical analysis, observed these compression patterns while developing his market theory in the 1890s.

Though he didn't specifically name the falling wedge, his writings about price action and volume relationships laid the groundwork for understanding why these patterns predict reversals so effectively.

Dow's pioneering work showed how declining volume during downtrends often preceded major rallies - a key characteristic of falling wedges.

Core Principles Behind Falling Wedge Reversals:

- The Psychology of Exhaustion

Sellers gradually lose momentum as prices fall, creating smaller downward waves. This exhaustion shows up in both price action and volume, with each new low requiring more effort from bears while producing diminishing results. The compressed price action signals that selling pressure is weakening while potential buying pressure builds. - Volume Tells the Story

Declining volume during the pattern formation indicates less conviction from sellers. When volume expands on upward price moves within the pattern, it suggests accumulation by informed buyers. This divergence between price and volume often precedes the eventual breakout. - Natural Market Cycles

Markets move in cycles of expansion and contraction. Falling wedges represent the final stage of a downtrend, where selling pressure naturally exhausts itself. Just as a spring compresses before release, prices coil tighter before breaking higher with renewed energy. - Statistical Edge

Research across multiple markets shows falling wedges successfully predict bullish reversals about 68% of the time. This high success rate stems from the pattern's ability to capture specific market conditions where downside momentum fades while buying pressure builds beneath the surface.

Practical Application Examples:

The 2020 stock market recovery provided a textbook falling wedge example. After the March crash, the S&P 500 formed a falling wedge over six weeks. Volume declined steadily while price ranges compressed - classic signs of seller exhaustion. The eventual breakout in May led to a sustained rally.

In cryptocurrency markets, Bitcoin displayed a falling wedge during December 2018's bear market bottom. Daily volume shrank by 70% as the pattern developed. When prices finally broke above the upper trendline, Bitcoin rallied 340% over the next six months.

Key Recognition Factors:

-

Converging trendlines sloping downward

-

Decreasing volume during pattern formation

-

Lower highs and lower lows, but with diminishing momentum

-

Price ranges becoming progressively smaller

-

Positive divergence in momentum indicators

Understanding these principles helps traders identify high-probability reversal opportunities. The falling wedge pattern works because it captures specific market conditions where selling pressure naturally exhausts itself while new buying interest builds. By combining pattern recognition with volume analysis and proper risk management, traders can use falling wedges to time market turns effectively.

Identifying High-Probability Trading Opportunities

The art of spotting reliable falling wedge patterns requires more than just recognizing two converging lines on a chart.

Successful traders develop a systematic approach to pattern validation, combining multiple technical factors that separate high-probability setups from potential false signals.

Price action forms the foundation of pattern recognition. Valid falling wedges display a clear sequence of lower highs and lower lows, with each swing becoming progressively smaller.

The upper and lower trendlines should converge at an angle between 15 and 45 degrees. Steeper angles often lead to false breakouts, while shallower angles may not generate enough momentum for meaningful reversals.

Pattern Validation Checklist:

-

Minimum of 3 reaction highs touching upper trendline

-

Minimum of 3 reaction lows touching lower trendline

-

Decreasing volume throughout pattern formation

-

Price compression visible in narrowing candlestick ranges

Volume Confirmation Signals

Volume analysis serves as the cornerstone of falling wedge validation, transforming potentially subjective patterns into high-probability trading opportunities.

The signature volume profile follows a distinct sequence that confirms the psychological shift from seller exhaustion to buyer accumulation.

During pattern formation, look for steadily declining volume as prices make lower lows—this decreasing participation confirms waning seller conviction.

The ideal scenario shows volume progressively diminishing by 30-50% from pattern start to completion.

Trading platforms with volume profile features can help identify key support levels where buying interest begins to cluster despite continued price decline.

The breakout phase requires particular attention to volume characteristics. Valid breakouts show a decisive volume expansion—typically 50-80% above the 20-day average—as prices penetrate the upper trendline.

This surge in participation confirms genuine buying pressure rather than a technical false break.

This volume signature indicates that selling pressure is weakening while buyers begin accumulating positions. Trading platforms with volume profile features can help identify key support levels where buying interest clusters.

Support and resistance levels within the pattern deserve special attention. Strong support often develops near the lower trendline, creating opportunities for early position building.

These levels frequently align with previous market structures like prior swing lows or moving averages. The most reliable patterns show respect for these technical levels with clear price reactions.

Key Support/Resistance Indicators:

-

Historical price levels showing multiple touches

-

Moving average convergence zones

-

Volume profile points of control

-

Fibonacci retracement levels

Time frame alignment strengthens pattern reliability. The most powerful setups show falling wedge formations across multiple time frames simultaneously.

For example, a daily chart pattern gains credibility when the 4-hour and 1-hour charts display similar compression patterns. This multi-timeframe confirmation helps filter out noise and identify stronger trends.

Pattern Dimensions and Proportions

Pattern height and duration also influence probability. The most reliable patterns typically develop over 20-30 price bars and show a height-to-width ratio between 2:1 and 3:1. Patterns outside these parameters may still work but require additional confirmation signals.

Momentum indicators add another validation layer. Look for positive divergence in indicators like RSI or MACD while prices make lower lows.

This divergence suggests underlying strength building despite falling prices. The combination of price compression, declining volume, and positive momentum divergence creates particularly compelling trade setups.

Smart traders recognize that context matters. Falling wedges showing up after extended downtrends, at major support levels, or during broader market accumulation phases tend to produce more reliable breakouts. These patterns carry extra weight when they align with seasonal tendencies or sector rotation patterns.

The final piece involves measuring trade potential against risk. Calculate the pattern's height from highest high to lowest low within the formation.

This measurement provides a minimum price target when projected from the breakout point. Compare this potential reward to the risk of a stop loss below the pattern's low to determine if the setup offers an acceptable risk-reward ratio.

Entry and Exit Strategies for Maximum Profit

The 2022 tech stock correction created prime falling wedge opportunities across multiple securities. Take Microsoft's pattern between September and December - a textbook setup that rewarded patient traders who followed systematic entry and exit rules.

Smart Entry Techniques

The most reliable entry method combines breakout confirmation with volume validation. Wait for a decisive close above the upper trendline (preferably 2-3% penetration) accompanied by above-average volume. This approach might sacrifice some initial gains but dramatically reduces false breakout risk.

Entry triggers should include:

-

Price closing above upper trendline resistance

-

Volume spike 50% or more above 20-day average

-

Bullish candlestick patterns at breakout point

-

RSI moving above 50 from oversold territory

Position sizing becomes critical for managing risk effectively. Start with a half position at initial breakout, adding the remainder after confirmation. This method, known as scaling in, protects capital while maintaining exposure to the anticipated move.

Stop Loss Placement

Protected profits require strategic stop loss placement. Set initial stops just below the last significant swing low within the pattern - typically 1-2 bars before breakout. This location:

-

Guards against normal price volatility

-

Keeps risk defined and measurable

-

Allows pattern room to develop

-

Maintains favorable risk-reward ratios

As price advances, implement trailing stops based on key technical levels. The 20-period moving average often provides a reliable trailing mechanism, keeping you in strong trends while protecting gains.

Target Setting and Profit Taking

Pattern height projection offers the primary profit target. Measure the vertical distance from pattern start to lowest point, then project upward from breakout level. This measurement provides a minimum target, though strong trends often exceed this level.

Multiple profit-taking levels increase consistency:

-

Take 1/3 profits at 1:1 risk-reward

-

Scale out another 1/3 at pattern height target

-

Let final 1/3 run with trailing stop

Time-based exits also merit consideration. If price fails to reach targets within 1.5 times the pattern's formation length, consider closing positions. Extended consolidation after breakout often signals diminishing momentum.

Real-Time Trade Management

Active management improves results. Monitor these key factors:

-

Volume maintaining above average on advances

-

Price holding above prior resistance levels

-

Momentum indicators remaining positive

-

Overall market conditions supporting direction

Consider the early 2023 gold market example: The February falling wedge triggered above $1,875, accompanied by surge in volume.

Traders who entered half positions at breakout, added on pullback to former resistance, and implemented trailing stops captured a significant portion of the move to $2,000+.

Success requires discipline and patience. Many traders exit too early on minor pullbacks or hold too long hoping for extended moves. Clear rules around position management, paired with mechanical exit criteria, remove emotional decision-making from the process.

Remember the principles covered in previous sections - pattern validation, volume analysis, and market psychology all play crucial roles in trade execution. Combine these elements with proper entry and exit rules to build a complete trading approach around falling wedge opportunities.

Common Pitfalls and How to Avoid Them

Trading falling wedge patterns presents unique challenges, even for experienced traders. Many technical analysts spot these formations easily enough but stumble during execution. The difference between consistent profits and repeated losses often comes down to avoiding common mistakes while following proven practices.

The Dos: Essential Practices for Pattern Success

-

Wait for Clear Confirmation

Rushing entries leads to losses. Allow price to close above the upper trendline on above-average volume. The Microsoft example from our previous section showed how waiting for a proper 2% breakout saved traders from multiple false signals. -

Scale Into Positions

Start with partial positions at initial breakout, adding on pullbacks to former resistance. This method protected traders during Bitcoin's 2019 wedge breakout, allowing them to build full positions with reduced risk. -

Use Multiple Time Frame Analysis

Compare patterns across different time frames before trading. A daily chart wedge becomes more reliable when 4-hour and hourly charts show similar compression patterns. -

Document Your Trades

Keep detailed records of entry reasons, stop placement, and target levels. Successful pattern traders review their decisions regularly, building pattern recognition skills through experience.

The Don'ts: Common Mistakes to Avoid

-

Don't Chase Extended Breakouts

Many traders jump in after the price has already moved significantly beyond the pattern. The ideal entry window closes quickly - wait for pullbacks if you miss the initial breakout. -

Don't Trade Patterns in Isolation

Always consider the broader market context and sector trends when evaluating falling wedges. Even textbook patterns can fail when they conflict with major market themes or institutional money flow. -

Don't Move Stops Too Tight

Giving patterns room to breathe matters. Setting stops too close to entry points often results in premature exits before the main move develops. -

Don't Fight Market Context

Even perfect patterns fail in opposing market conditions. The strongest setups align with broader market trends and sector momentum.

Developing a Systematic Trading Approach

Pattern analysis requires constant attention to detail. Successful traders combine technical skills with disciplined risk management, creating a systematic approach to pattern trading.

Think of each trade as an experiment - document your process, learn from results, and refine your method over time.

Risk management deserves special emphasis. Many traders focus exclusively on entry signals while neglecting position sizing and stop placement.

Remember the trailing stop strategy discussed earlier - it protects profits while allowing trends to develop naturally.

Navigating False Breakouts

False breakouts represent another major challenge. These deceptive moves shake out impatient traders before the real move begins.

Combat this by requiring multiple confirmation factors working together:

First, look for strong volume confirmation that validates the price movement.

Next, ensure there's clear price action above resistance levels that sustains itself.

Third, verify positive momentum divergence in technical indicators.

Finally, confirm support from broader market conditions aligns with your trade thesis.

Professional traders treat falling wedge patterns as probability-based setups rather than guaranteed signals.

They understand that even the best patterns fail occasionally, making proper risk management essential for long-term success.

Practice identifying these patterns in real-time market conditions before risking capital. Paper trading helps develop pattern recognition skills while testing various entry and exit strategies.

The experience gained through careful observation and documented practice builds the confidence needed for successful pattern trading.

Remember: consistent profits come from avoiding major mistakes rather than seeking perfect entries. Focus first on protecting capital through proper position sizing and stop placement. Let winning trades run while cutting losses quickly when patterns fail.

Mastering the Falling Wedge Strategy

Studying these real-world cases improves pattern recognition skills while reinforcing proper trading methodology.

Markets constantly evolve, but the psychological principles underlying falling wedge patterns remain remarkably consistent across different assets and timeframes.

The most successful traders approach these setups with both technical precision and psychological discipline.

They recognize that falling wedges aren't merely chart formations but visual representations of shifting market sentiment—the gradual transition from seller exhaustion to renewed buyer conviction.

By combining the technical framework outlined in this guide with rigorous practice and thoughtful execution, traders can develop the confidence to identify and capitalize on these high-probability reversal opportunities while maintaining appropriate risk parameters.

The falling wedge pattern, when properly understood and applied, remains one of technical analysis's most reliable tools for anticipating significant market turns.