Introduction

As traders, we’ve all been there. The market's a chaotic mess, and you're the sucker always buying high and selling low. It can feel like you're the punchline in some cosmic joke, right? But here's the real gut punch: while you're fumbling in the dark, others are raking in cash. They've cracked the code—a secret language hidden in plain sight. It's there in every candlestick, every trend line, screaming at you. Chart patterns. They're the difference between being the house or the desperate gambler. Ready to flip the script? Good. Because we're about to decode the only dialect that matters in the gladiator pit of day trading. Time to stop being the mark and start being the shark.

What Are Chart Patterns?

Chart patterns are the fingerprints of mass hysteria. They're what's left behind when thousands of traders, each thinking they're a genius, smash their buy and sell orders against each other. It's a visual representation of greed and fear duking it out on a grand scale. You've got your head and shoulders, your cups and handles, your flags and pennants - each one a battlefield scar from the endless war between bulls and bears. But here's the real mind-bender: these patterns repeat. Over and over. Because at the end of the day, we're all just monkeys in pants, prone to the same emotional outbursts whether we're trading tulips in 1637 or tech stocks in 2024.

“The market is a device for transferring money from the impatient to the patient.”

Buffett nailed it, but he left out the best part: chart patterns are your cheat code to figuring out who's who in that equation.

The Psychology Behind The Scenes

Ever wonder why you keep falling for the same tricks? It's because your brain's wired that way. Chart patterns are just your lizard brain on full display, magnified by millions of other traders doing the exact same dance. You see a double top forming, and suddenly you're transported back to that time you got burned on a failed breakout. Your palms sweat, your heart races, and boom - you've pulled the trigger on a trade before your rational mind can catch up. Congratulations, you've just become another data point in the grand experiment of market psychology.

Here's the kicker: everyone else is doing it too. That's why these patterns work. They're a self-fulfilling prophecy, a shared delusion we all buy into:

- Fear: Drives panic selling, creating those juicy oversold conditions

- Greed: Fuels buying frenzies, pushing prices to unsustainable heights

- Hope: Keeps people holding onto losers, forming those long, drawn-out bases

- Regret: Triggers chase-ins after a breakout, adding fuel to the trend

The Herd Mentality

You're not special. Neither am I. We're all part of the herd, and that's okay. The trick isn't to fight it - it's to spot when the herd's about to stampede, and position yourself accordingly. Master this, and you'll find yourself on the right side of the trade more often than not.

Common Bullish Setups

Welcome to the optimist's playground. Bullish patterns are where dreams of Lamborghinis and private islands are born. They're the formations that signal the bulls are ready to run, and the bears are about to get trampled. But here's the thing: recognizing these patterns is only half the battle. The real skill is in knowing when they're legitimate and when they're just a mirage in the desert of your desperation. Let's break down some of these hope-inducing formations.

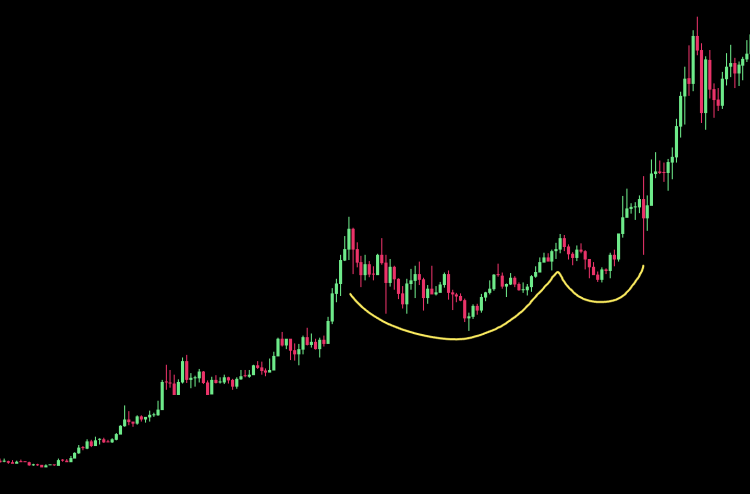

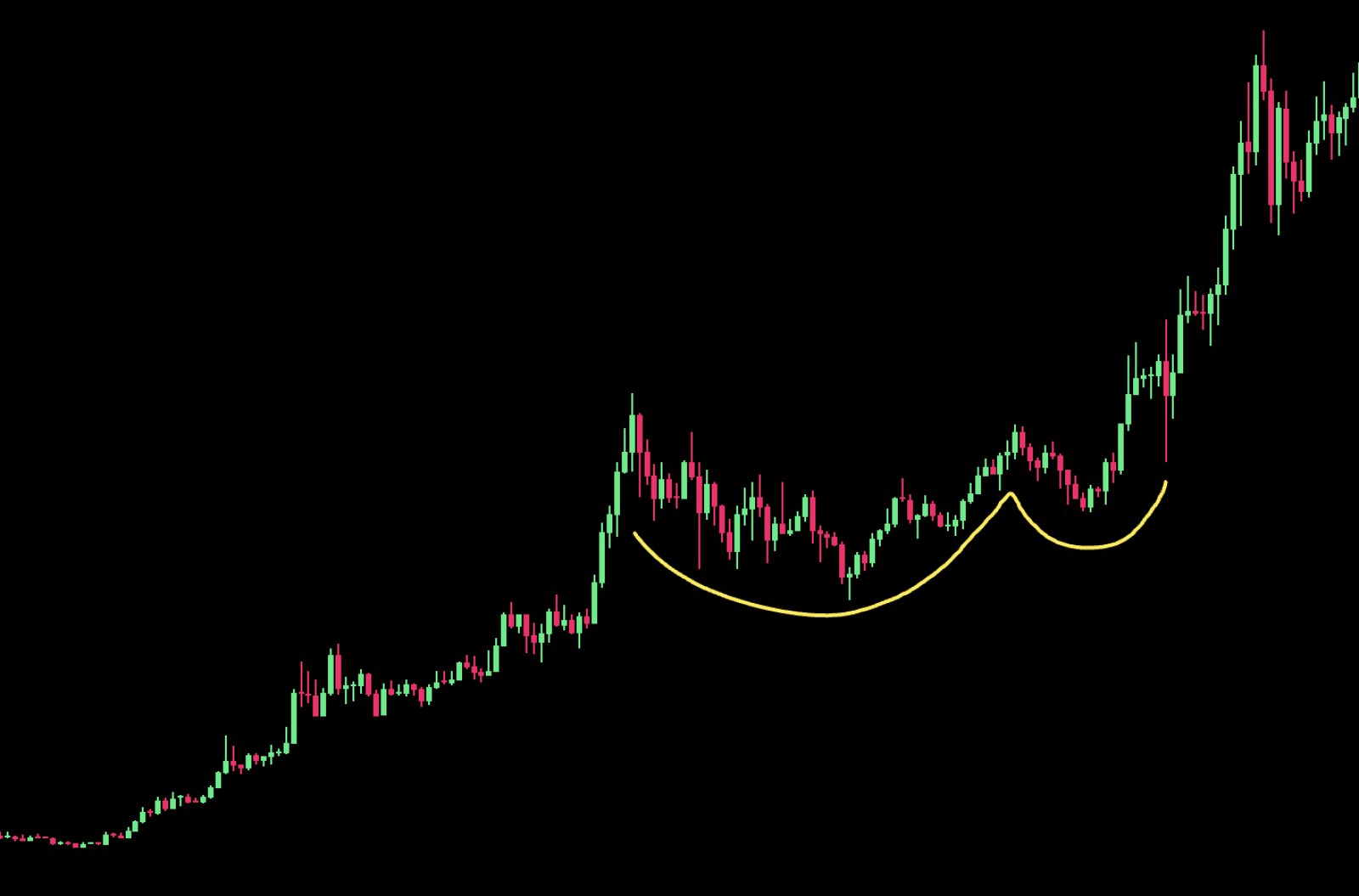

Cup and Handle

Imagine the market's just handed you a steaming cup of potential profits. The price dips, forming a U-shape, then pulls back slightly, creating a handle. It's like the chart's inviting you to grab hold and enjoy the ride up. But don't get too comfortable - this pattern can take weeks or even months to form. Patience is key, or you'll end up spilling that cup all over yourself.

Bull Flag

Picture a flagpole of rapid price increase, followed by a neat little rectangle of consolidation. That's your bull flag. It's the market catching its breath before the next sprint upwards. Traders love this pattern because it's relatively quick to form and easy to spot. But remember, not every flag leads to victory. Sometimes it's just the market waving goodbye to your money.

Inverse Head and Shoulders

This pattern is like the Loch Ness monster of trading - everyone's heard of it, but few have seen it play out perfectly. You've got a lower low sandwiched between two higher lows, forming a shape that looks like an upside-down head and shoulders. When the price breaks above the "neckline," it's supposedly off to the races. But don't bet your life savings on it - this pattern has a nasty habit of faking out even seasoned traders.

Ascending Triangle

Imagine a ceiling of resistance that the price keeps bumping its head against, while the lows get higher and higher. That's your ascending triangle. It's like watching a pressure cooker - eventually, something's got to give. When the price finally breaks through that resistance, it can shoot up like a rocket. Or it can come crashing down, reminding you that in trading, nothing is certain except uncertainty itself.

Common Bearish Setups

Welcome to the dark side of trading. Bearish patterns are where fortunes crumble and dreams turn to dust. They're the formations that whisper, "Winter is coming," to those who know how to listen. But here's the twist: in the world of trading, winter can be just as profitable as summer if you're prepared. These patterns aren't omens of doom; they're opportunities in disguise. The trick is knowing how to dance with the bear without getting mauled.

Head and Shoulders

The crown jewel of bearish patterns, and the bane of every overly optimistic bull. Imagine a peak (the head) flanked by two lower peaks (the shoulders). When the price drops below the neckline connecting these shoulders, it's like watching a roller coaster crest the top of the track. The descent can be swift and merciless. But remember, not every bump is a head, and not every dip confirms the pattern. False signals abound, ready to trap the trigger-happy trader.

Double Top

The market's way of saying, "Fool me once, shame on you. Fool me twice, shame on me." Price hits a high, pulls back, then rallies to the same level before losing steam again. It's like watching a boxer throw two punches and miss both times. When the price breaks below the support level between these tops, it's often a sign that the bulls have run out of steam. But be warned: sometimes that second top is just a pause before the real breakout.

Descending Triangle

Picture a floor of support that the price keeps testing, while the highs get lower and lower. It's like watching air slowly leak from a balloon. Traders eye this pattern like vultures circling a wounded animal, waiting for that support to finally give way. When it does, the drop can be dramatic. But don't get cocky - sometimes that support holds, and the pattern transforms into a launchpad for a bullish reversal.

Bear Flag

The evil twin of the bull flag. After a sharp drop (the flagpole), the price consolidates in a slight upward channel (the flag). It's the market taking a breather before the next leg down. Traders salivate over these patterns because they're compact and offer clear entry and exit points. But here's the catch: sometimes that flag is actually a surrender flag for the bears, and the trend reverses. Always wait for confirmation before diving in.

Continuation Setups: When the Trend is Your Friend

Imagine you're riding a wave. It's exhilarating, powerful, and you're making progress. But suddenly, the wave seems to lose momentum. Do you bail out? Or do you hold on, trusting that the surge will continue? That's the essence of continuation patterns. They're the market's way of catching its breath, like a sprinter pausing before the final dash to the finish line. These patterns are the sweet spot where patience meets opportunity. But beware - sometimes what looks like a pause is actually the end of the line. Let's break down these mid-trend pit stops.

Rectangle

Think of a rectangle as the market's indecision box. Price bounces between clear support and resistance levels, like a ping pong ball in slow motion. It's a tug-of-war between bulls and bears, with neither side gaining the upper hand. The key is to wait for the breakout. When price finally escapes the box, it often continues in the direction of the prior trend with renewed vigor. But don't get complacent - sometimes the rectangle is just the eye of the storm before a major reversal.

Pennant

Picture a triangle that forms after a sharp price movement. It's like the market's taking a quick breather, gathering strength for the next move. Pennants are typically short-lived - blink and you might miss them. They're formed by lower highs and higher lows, creating a compression zone that's ready to explode. When the breakout happens, it's often explosive, continuing in the same direction as the initial trend. But here's the kicker: false breakouts are common, ready to trap the impatient trader.

Ascending or Descending Triangle

These are the marathon runners of continuation patterns. An ascending triangle in an uptrend or a descending triangle in a downtrend can be a powerful signal that the party's not over yet. In an ascending triangle, you'll see a flat top resistance with rising support. It's like watching pressure build in a champagne bottle - when it pops, the move can be spectacular. But remember, sometimes the cork stays put, and the fizz fizzles out.

Flags

Flags are the sprinters of the pattern world. They form quickly and resolve even faster. After a sharp move, price consolidates in a channel that goes against the prevailing trend. It's like a runner taking a few steps back before leaping forward. When price breaks out of the flag, it often continues the original trend with gusto. But here's the trap: not every flag waves you toward profit. Some are false signals, ready to lead you astray if you don't confirm the breakout.

Volume: The Heartbeat of Chart Patterns

Volume is the pulse of the market, the invisible force that gives life to chart patterns. It's the difference between a genuine move and a head fake, the secret sauce that separates the amateurs from the pros. Without volume, chart patterns are just pretty pictures - meaningless doodles on a screen. But add volume to the mix, and suddenly those lines and shapes start speaking to you. It's like putting on 3D glasses at the movies - everything pops into sharp relief. But here's the catch: reading volume isn't just about big bars and small bars. It's about context, timing, and the subtle interplay between price and volume. Let's break down the key principles of volume analysis that'll turn you from a chart-gazing newbie into a pattern-reading ninja.

- Trend Confirmation: Rising volume in the direction of the trend? That's your green light. The trend is your friend, and volume is its wingman.

- Divergence: Price making new highs but volume shrinking? Red flag. It's like a party where people are slowly sneaking out the back door.

- Breakouts: A surge in volume during a breakout is like rocket fuel. No volume? That breakout might fizzle faster than a wet firecracker.

- Reversals: Big volume spikes at potential reversal points are like neon signs saying "Pay attention!" It's the market screaming that something's about to change.

- Accumulation/Distribution: Low volume pullbacks in an uptrend often signal accumulation. High volume drops in a downtrend? That's distribution, baby.

- Climax Volume: Massive volume spikes can signal exhaustion and potential reversal. It's like watching the last runner collapse at the finish line.

- Volume Dry-Ups: Super low volume can precede explosive moves. It's the calm before the storm, the silence before the crowd roars.

Real-World Application: Putting Patterns to Work

So you've memorized every chart pattern known to man. Congratulations, you're now equipped with a toolbox full of theoretical knowledge that's about as useful as a chocolate teapot in the real world of trading. The truth is, recognizing patterns is the easy part. It's what you do with that information that separates the wheat from the chaff, the pros from the amateurs, the winners from the "I'll get 'em next time" crowd. Applying chart patterns in real-world trading is like trying to drink from a fire hose while riding a unicycle - it's chaotic, overwhelming, and if you're not careful, you'll end up flat on your face. But fear not, intrepid trader. With the right approach, you can turn that chaos into cold, hard cash. Let's break down how to put these patterns to work without losing your shirt - or your mind.

The Five Commandments

- Thou shalt not trade every pattern: Just because you see a pattern doesn't mean you have to trade it. Selectivity is your friend.

- Thou shalt always consider context: A bullish pattern in a bearish market is like bringing a knife to a gunfight. Know the bigger picture.

- Thou shalt not ignore volume: Volume is the heartbeat of patterns. No volume, no party.

- Thou shalt always use stop losses: Even the best patterns fail. Protect your capital like it's the last slice of pizza.

- Thou shalt not bet the farm: Position sizing is key. No pattern is a sure thing, so don't trade like it is.

The Art of Pattern Recognition: Practice Makes Profit

You've reached the final boss level of chart pattern mastery. Congratulations, you're now armed with enough knowledge to be dangerous - mostly to yourself. See, knowing patterns is like knowing the rules of chess. It's a start, but it won't make you a grandmaster. The real skill lies in pattern recognition - the ability to spot these formations in the wild, amidst the chaos of real-time price action. It's the difference between reciting boxing combinations in your bedroom and ducking a real punch in the ring. This is where the rubber meets the road, where theory transforms into cold, hard cash.

But here's the kicker: you can't learn this from a book or a YouTube video. It's a skill honed through hours of chart time, through the school of hard knocks and missed opportunities. It's about training your brain to see order in chaos, to spot the signal in the noise. And the only way to get there? Practice, practice, and when you're sick of practicing, practice some more. Your mission, should you choose to accept it, is to become a human pattern-recognition machine. Your eyes should bleed charts, your dreams should be in candlesticks. Only then will you start to see the matrix of the markets, the hidden language of supply and demand.

So strap in, buckle up, and get ready for the ride of your life. The path to pattern mastery is long and fraught with peril, but the view from the top? Well, that's where the real profit lies.